Table of Content

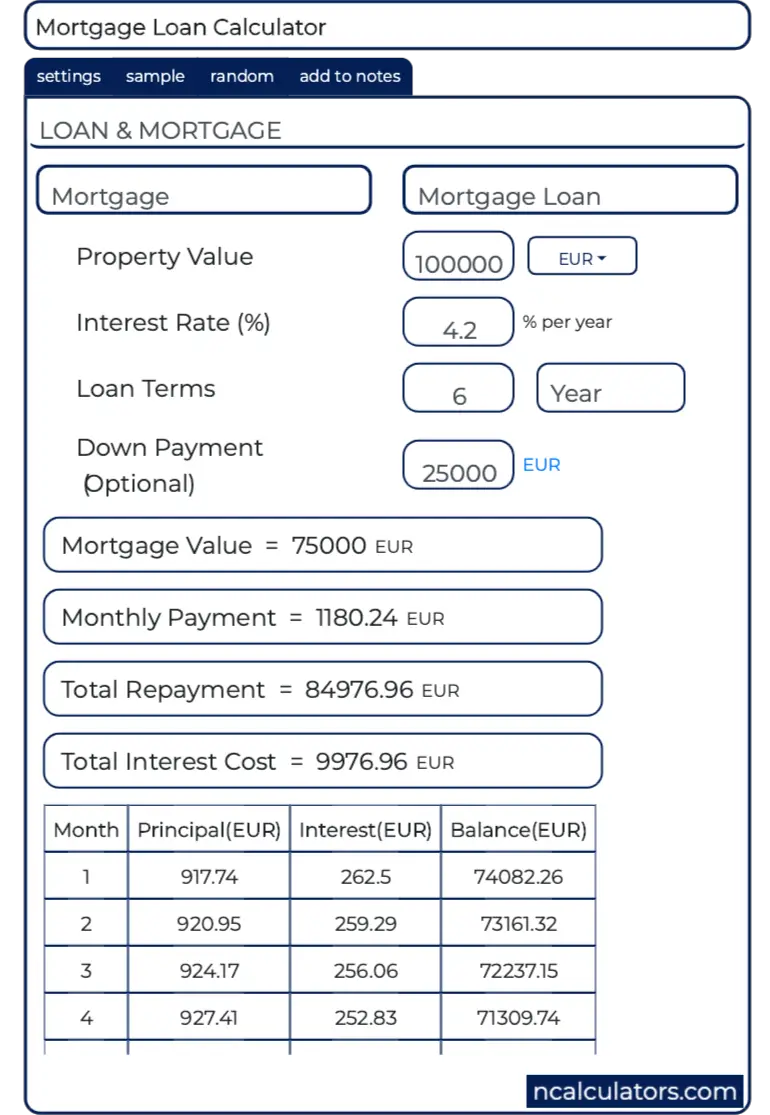

Buying points means youâd pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate. Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

But when you’re borrowing a large sum for a long time, a 0.25% rate reduction can add up to tens of thousands of dollars over the lifetime of the loan. Be sure to shop around and find the best VA mortgage rate available to you. In addition to assumptions above, current advertised rates for IRRRLs assume a 60-day lock period. Points are generally more advantageous to borrowers who plan to own the home for a longer period of time.

Recap: How mortgage interest rates have moved over the past week

A fixed-rate mortgage is a home loan with a rate of interest that remains constant throughout the life of the loan. Generally speaking, the best time to borrow a loan is when you know you can afford it. You might also want to spend some time on improving your credit score before applying so you can get the best quote. Besides having a minimum score of 620, you must also have enough residual income, an appropriate debt-to-income ratio, and a fair credit history to satisfy the lender’s requirements.

The Services may contain links to third party websites and services. Interest.com provides such links as a convenience, and does not control or endorse these websites and services. All other fees must be paid in cash at closing after negotiations to determine whether the buyers or sellers are responsible for them. For borrowers with poor credit or very little spare cash, there's no other mortgage product out there that comes close to offering the affordable options that VA mortgages do. Weight your options carefully, but be sure to give a lot of consideration to VA home loans.

VA home loan programs for surviving spouses

APR rates for 30-year loans are offered as low as 2.631%, while the 15-year loan APR is offered as low as 2.997%. To help take the guesswork out of the process, you’ll find some of the best VA loan rates available through the lenders below. This guide will also cover the fundamentals of VA loans and what you need to know when choosing between these top VA lenders. Evan Banning, president of California Housing and Lending, a real-estate brokerage and mortgage firm in San Diego, said he refinanced a loan for a vet and active reservist in mid-January. The client had purchased a house for $1.7 million a few years earlier with 10% down, but didn’t use a VA loan. Under the prior VA rules, refinancing would have required his client to boost his home equity.

Learn how VA-backed and VA direct home loans work—and find out which loan program might be right for you. We’ll calculate your funding fee as a percentage of your total loan amount. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

When Do VA Loan Limits Apply?

Answer a few questions below to speak with a specialist about what your military service has earned you. However, if you received a bad conduct, dishonorable, or “other than honorable” discharge, you would not be eligible, although you can apply to the VA to upgrade your discharge status. You are a surviving spouse who has not remarried after the death of a veteran while in service or from a service-connected disability.

VA loans usually have no or low down payment requirements and lower interest rates than traditional mortgage products. They also tend to be more flexible, allowing for a higher debt-to-income ratio and lower credit scores, and don’t require private mortgage insurance . Your credit and financial situation, as well as the economy, affect the rate of your VA loan. If you have a low credit score, you will pay a higher interest rate for a mortgage. A credit score of 620 or higher will help you qualify for a more advantageous VA loan rate, but the VA does not set a minimum credit score requirement. Similar to an interest rate, APR is also expressed as a percentage.

How do I find current VA mortgage rates?

You might be surprised that you can easily get approved by one lender but not another. Be sure to shop with at least three VA-approved mortgage lenders to find the best VA mortgage rate for your situation. By comparing offers from multiple lenders, you can find not only the loan with the best interest rate, but also with the lowest fees.

Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation. Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172.

Here is a table listing lenders by loans backed, average loan amount & total lending over fiscal year 2018. Check with the lenders that you are looking at to see if any of them offer this service. The reason VA loans are able to charge a lower rate than other mortgages is the Veteran's Administration guarantees to pay the lender up to 25% of the value of the home. This means if a buyer bought a house for $500,000 & was foreclosed on the VA would cover the lender for any loses up to $125,000.

Since every Loan Estimate form is the same, its a vital tool for comparing mortgage lenders and avoiding excessive fees. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. You will need a COE, which you can obtain from the VA website, or your lender can assist you with this. To get this certificate, you’ll have to produce service-related documentation, which can vary based on whether you are on active duty or a veteran. Lending Tree offers multiple types of loans including VA loans with ARMS of varying lengths. The PenFed Foundation is a nationally recognized 501 nonprofit.

To be eligible for a VA home loan, you need to meet the Department of Veterans Affairs’ minimum service requirements. If you’re eligible, try this VA mortgage calculator to see how much home you might be able to afford. Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. VA loans have specific appraisal and home inspection requirements, which allows buyers to feel more confident in the property they are purchasing, Parker also points out. For today, Thursday, December 22, 2022, the national average 30-year VA mortgage APR is 5.89%, up compared to last week’s of 6.27%.

Whether you're buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click "Next" to get started in finding your personalized quotes. The average 30-year VA refinance APR is 6.21%, according to Bankrate's latest survey of the nation's largest mortgage lenders. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products.

No comments:

Post a Comment